The Florida Association of Realtors consolidates local association data from across the state and provides the previous month’s data to member Realtors through the SunStats reporting system. We then analyze the data for our local South Florida markets and generate this summary report and infographics for Broward, Miami-Dade and Palm Beach Counties.

Median prices are up, despite low volume and increasing inventory

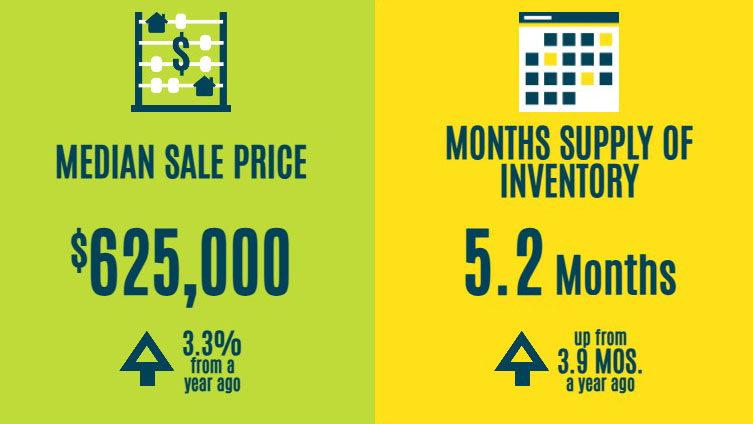

South Florida home sales were down drastically from last September, while inventory continued to rise at a steady pace. Median prices, however, were up 6.5% on average for all property types across the tri-county area. To put it in perspective, prices have increased every year about 5.5% on average since 1974. It seems that despite dismally low sales volume, property values in South Florida are holding strong. We expect demand to get back to normal this winter, which should continue to prop prices up.

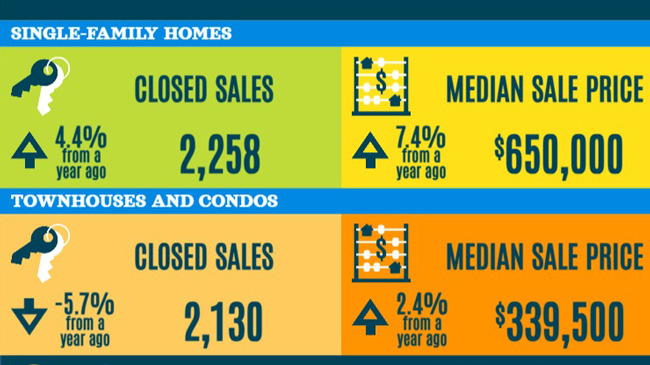

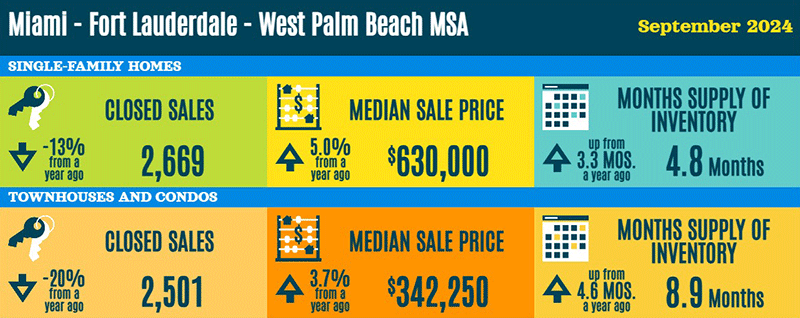

Single family home sales were down 13% from last year in the tri-county area, but median prices were up 5% to $630,000. This is down slightly from an all-time high of $650,000 in June. Inventory is still low at only 4.8 months of supply. This is still a seller’s market, but very slowly approaching equilibrium.

Condo sales were down a whopping 20% from last September. Despite this sharp drop in volume, median sale prices were up 3.7% to $342,250. Condo inventory in South Florida is up to 8.9 months of inventory. This is the most condo inventory we have had since December of 2011. While this is technically a buyer’s market, most buyers aren’t seeing it reflected in their sale prices.

Condo inventory is up to 8.9 months of supply. This is the highest inventory has been since December of 2011.

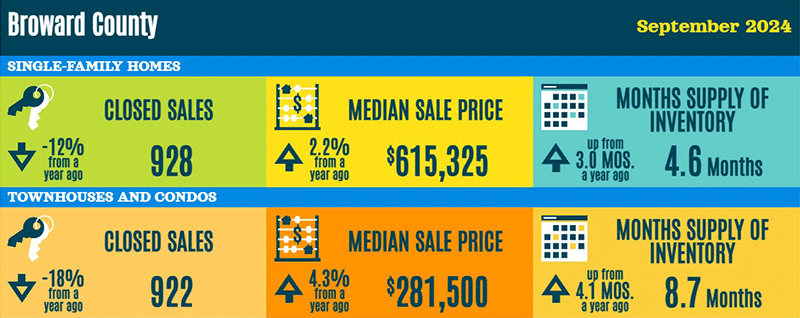

Broward County

The median sale price for a single family home in Broward County was up 2.2% over last year to $615,325. However, this is still below the all time high of $640,000 last June. Inventory remains low at 4.5 months of supply. This is still a seller’s market and the lowest single family inventory in South Florida.

The median sale price for condos and townhomes in Broward County was up 4.3% to $281,500 despite dismally low sales volume that was down 18% from last year. Condo inventory in Broward has more than doubled since last year at 8.7 months.

The single family market in Broward County is still favoring sellers with only 4.6 months of supply, the lowest inventory in South Florida.

Broward County, Florida includes the coastal communities of Fort Lauderdale, Pompano Beach, Lauderdale-by-the-Sea, Lighthouse Point, Hillsboro Beach and Deerfield Beach.

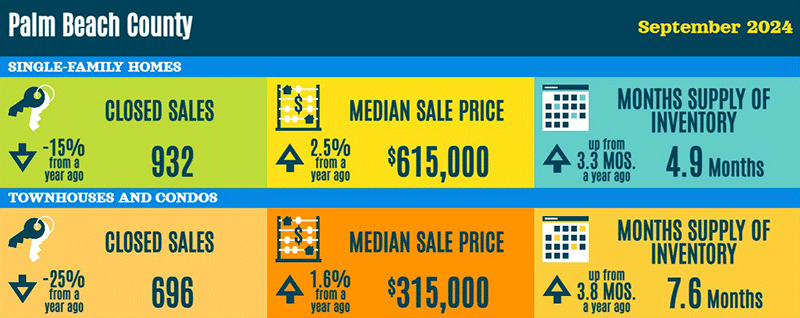

Palm Beach County

The median sale price of a single family home in Palm Beach County was up 2.5% over last year to $615,000, but down from the peak of $660,000 in June. Single family inventory is up slightly, but remains low at only 4.9 months of supply. This is still a seller’s market.

The median sale price of condos and townhomes in Palm Beach County is up 1.6% to $315,000. Condo inventory is the tightest in South Florida with only 7.6 months of supply.

Condo inventory in Palm Beach County is still the lowest in South Florida at 7.6 months of supply. This is effectively an equilibrium market, not favoring buyers or sellers.

Palm Beach County, Florida includes the coastal communities of Boca Raton, Delray Beach, Boynton Beach, Lantana, Manalapan, West Palm Beach, Singer Island, North Palm Beach, Juno Beach and Jupiter.

Miami-Dade County

The median sale price of a single family home in Miami Dade County was up 8.9% from last year to $653,400. This is still the highest single family median price in South Florida. Inventory was up slightly to 5.1 months of supply.

The median price for condos and townhomes in Miami Dade County was up just 1.2% to $420,000. Prices have remained relatively flat as inventory has now topped 10 months of supply in Miami-Dade.

Condo inventory in Miami-Dade County has topped 10% keeping median sale prices relatively flat.

Miami-Dade County includes the coastal communities of Miami, Miami Beach, Sunny Isles Beach, Golden Beach, Bal Harbour, Surfside and Key Biscayne.

Summary

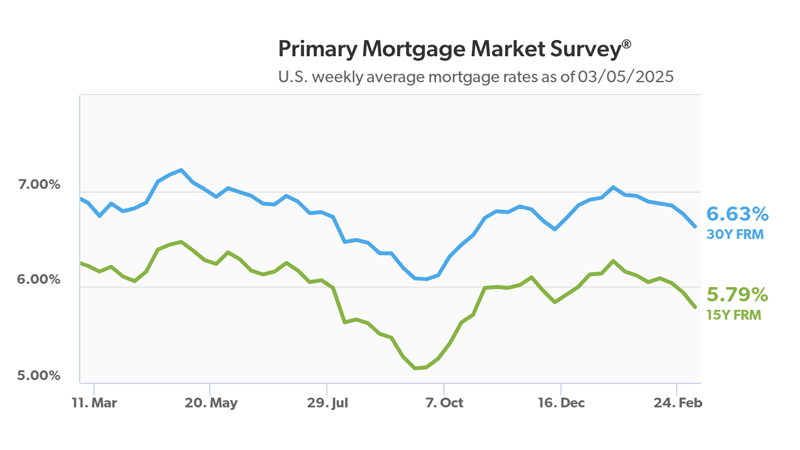

Our single family markets remain strong throughout South Florida with low supply and steadily increasing median sale prices. Sales volume is still historically low, but that should change quickly as we put the election behind us and get into the winter busy season. Now is a good time to buy, but the best properties are in high demand. Find an agent who specializes in our local market. Their hard work, patience and local knowledge will pay off.

Many of our older condo buildings are still working through their required inspections and resulting special assessments. Sales volume is down in these buildings since financing is more difficult and even impossible for some buildings. As more associations catch up with deferred maintenance we expect to see increased buyer demand for condos. In the meantime, an experienced local agent can help buyers and sellers navigate this challenging condo market.

Are you thinking of selling? Every seller situation is different, so its hard to say if now is your best time to sell. For example, if you own a single family home in a tight market and you are considering downsizing to a smaller condo, then now might be a perfect time. Consult with your By The Sea Realty agent to determine your best sell/buy strategy. We utilize a suite of seller tools to help you accomplish your real estate goals. Its starts with our industry leading Cloud CMA.

For a detailed market analysis of your condo or single family home, or for professional assistance with your home search in South Florida please contact one of our local trusted agents.